$25 million investment in Vietnam to create jobs

Swedfund invests $25 million in vietnamese bank VP to reach small and medium-sized companies and create more jobs and it is Swedfund's first direct investment in the financial sector in Vietnam.

Swedfund invests $25 million in vietnamese bank VP to reach small and medium-sized companies and create more jobs and it is Swedfund's first direct investment in the financial sector in Vietnam.

Swedfund invests USD 10 mn in the Asian fund AFMF. The purpose is to support SMEs and contribute to job creation and development, including through the promotion of gender equality, climate resilience, strong ESG standards and financial inclusion in Cambodia and Laos.

Swedfund invested USD 30 million on the 1st of March in the Mirova Gigaton Fund . The main purpose of investing in the fund is to reach out to projects in developing countries, with debt financing through a wide range of important, complementary solar energy solutions outside the regular grid, so-called off-grid solutions.

Swedfund invests USD 5 million in the Somali fund NHAO (Nordic Horn of Africa Opportunities Fund). "Since the fund aims to support women-led companies and companies employing many young people, this is a very good opportunity to reach companies and businesses directly contributing to jobs and strengthening the Somali economy", says Maria Håkansson, CEO of Swedfund.

Swedfund will assist Ukraine in their ambition to establish and implement a 112-system. Today, Ukraine has different emergency numbers for police, rescue, and ambulance. We very much appreciate Swedfund's support for this project, says Ukraine's Deputy Interior Minister Igor Bondarenko.

On December 16, Swedfund invested USD 26 million in African Infrastructure Investment Fund 4 (AIIF4). This is the first investment Swedfund has made in broader infrastructure that includes more than just clean energy and climate infrastructure.

Swedfund invests an additional USD 4 million in loan financing in Kinyeti Venture Capital (Kinyeti), alongside the Norwegian Development finance institution Norfund. Kinyeti’s target is to assist in building the private sector in South Sudan by offering capital to entrepreneurs and to growing businesses which supports job creation.

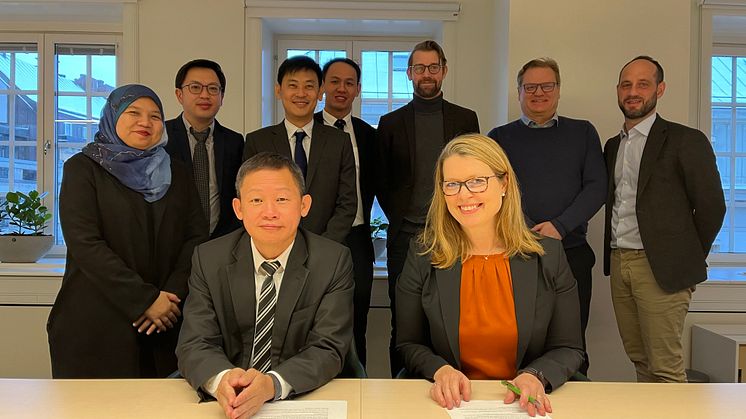

On December 12th, a cooperation agreement was signed between Swedfund’s Project Accelerator and the Malaysian company Sarawak Energy for a technical study on battery solutions in the Sarawak region, Malaysia, to enable the transition to renewable energy.

To support the development of small enterprises (MSMEs) and individuals in sub-Saharan Africa, Swedfund is investing an additional EUR 15 million in the microfinance institution Platcorp, targeted at clients in Kenya, Uganda and Tanzania.

Swedfund increases its financial commitment to EFP/ICCF by EUR 10 million. It is a financial platform created by the European development financiers to create jobs and combat climate change.

On November 25th, Swedfund invested USD 35 million in the Climate Investor Two fund. The main purpose of the investment is to finance projects and activities in developing countries for climate adaptation, i.e. adaptations of societies to the effects of climate change. The fund will also contribute to climate change mitigation.

Swedfund Project Accelerator cooperates with Escom Malawi in developing the Eastern Backbone transmission grid upgrade project. By improving the grid, more people and industries can get reliable access to power.