Press release -

FMO, CDC Group, Swedfund and IFC participate in first close of Nepal-focussed Dolma Impact Fund II

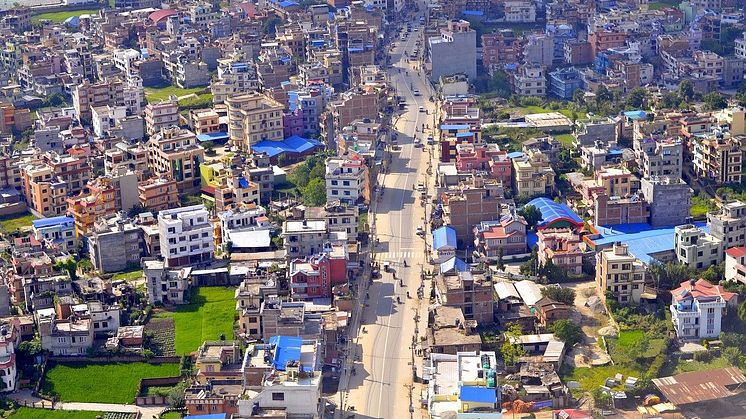

Kathmandu, Nepal, May 11, 2021—Dolma Fund Management announces the first close of Dolma Impact Fund II (Dolma II) – a private equity fund investing primarily in renewable energy, healthcare and technology in Nepal. Investors in this $40m first close are FMO, the Dutch entrepreneurial development bank; CDC Group, the UK’s development finance institution and impact investor; Swedfund, the Swedish development finance institution; and the International Finance Corporation (IFC). The final close is targeted at $75m.

The timing is important as COVID cases rise in Nepal, following the trend in India. Dolma II’s target sectors will directly address capacity constraints in healthcare and enable digital solutions to scale rapidly that will be vital both during and following the pandemic.

Pre-COVID, Nepal was one of the world’s fastest growing economies, achieving GDP growth rates of between 6.7% and 8.2% in 2017-2019, according to the World Bank, as it continues its journey towards Middle Income status. Even in 2020, Nepal outperformed its South Asian peers. Dolma II is part of a shift towards increased foreign direct investment (FDI) in Nepal, a country with a population of almost 30 million. Dolma II follows the success of Dolma Impact Fund I (Dolma I) which pioneered institutional FDI and Environmental and Social standards from 2014 in this high-growth emerging market. Dolma I’s portfolio includes almost 50 MW of renewable energy, some of the country’s leading AI and e-commerce firms, and much-needed pharmaceutical manufacturing and medical care.

Other foreign investment successes in Nepal include an internet service provider, mobile telco and hydropower projects, while long-established multinationals such as Standard Chartered, Unilever and Coca-Cola continue to thrive in the country. To further accelerate FDI, Nepal Invests platform was launched last month by CDC, FMO and the Swiss Agency for Development and Cooperation (SDC).

Tim Gocher, CEO, Dolma Fund Management said: “Our second fund is an international vote of confidence in Nepal’s private sector and talent. Our first fund demonstrated the commercial and impact opportunities in Nepal. Dolma Impact Fund II is a big step to opening these opportunities to a broader set of foreign investors to whom impact is a priority”.

Jaap Reinking, Director Private Equity, FMOsaid: “As an anchor investor in Dolma Impact Fund I, we’re excited to invest in Dolma Fund Management’s second fund. Not only does this support our ambitions towards accelerating climate action, financial inclusion, and reducing inequalities, it also focuses on improving environmental and social conditions for many Nepalese workers and businesses. We are proud to support Dolma Fund Management as it will invest in the emerging tech sector and much-needed healthcare services and jobs in Nepal.”

Srini Nagarajan, Managing Director and Head of Asia, CDC Group, commented: “Following the launch of Nepal Invests, CDC’s investment in Dolma Impact Fund II reiterates our commitment to helping draw greater FDI to Nepal, particularly into sectors, such as renewable energy, technology, healthcare and education, where there are opportunities for high social impact. We are pleased that our commitment will play a role in supporting the country’s post-pandemic economic recovery, help enhance digitisation, boost skills development and facilitate a thriving and resilient economy.”

Gunilla Nilsson, Head of Energy & Climate, Swedfund, said: “Dolma Impact Fund II focuses on Swedfund’s three core sectors (renewable energy, financial inclusion and healthcare) while technology and increased digitalization are over-arching themes for us. A strong driving force behind our investment is to increase the number of decent jobs in the formal sector and stimulate the local economy in Nepal. We are pleased that the fund is also expected to contribute to women's economic empowerment and meets the 2X Challenge criteria.”

Babacar S. Faye, Resident Representative, IFC commented:“Private equity funds can be an important source of capital and expertise for local entrepreneurs in Nepal—particularly in allowing them to expand their businesses, create more jobs, and provide essential goods and services. IFC is working towards deepening the private equity market in Nepal. Dolma is our second investment in this sector, and we hope that this will have a demonstration effect, beyond the financial returns, and attract more investments. This market will continue to grow if also supported by additional enabling reforms.”

Dolma Impact Fund I and II target risk-adjusted market returns while their impact is aligned to Nepal’s SDG targets. For SDG 5 – Gender Equality, Dolma II qualifies for the 2X Challenge, to drive gender balance in the portfolio. For SDG 8, 9 and 10 – relating to Work, Industry and Inequality, Dolma I’s portfolio companies generated quality employment for almost 5,000 people in Nepal since 2014. The majority of these jobs are for youth under 35. Over the same period, an estimated 2 million mostly young workers left Nepal to work abroad. For SDG 7 and 13 – Clean Energy and Climate Action, Dolma I’s renewable energy portfolio will avoid 219,000 tonnes of CO2 emissions annually. Further reducing polluting emissions in Dolma II is a priority as the Himalayan glaciers are set to lose two thirds of their mass in a business-as-usual scenario, according to the International Centre for Integrated Mountain Development (ICIMOD), threatening the 600m people living downstream with devastating floods.

ENDS

Notes to Editor:

Source: The World Bank, GDP growth (annual %) – Nepal

Source: Government of Nepal, Ministry of Labour Employment and Social Security: Nepal Labour Migration Report 2020

Media Contacts:

Dolma Fund Management: Tim Gocher, CEO | tim@dolmafund.org| www.dolmaimpact.com

FMO: Anneloes Roeleveld | A.Roeleveld@fmo.nl | T: +31 70 314 9357

CDC Group:Toyosi Adebayo | tadebayo@cdcgroup.com | press@cdcgroup.com

Swedfund: Katinka Wall | katinka.wall@swedfund.se | +46 8 725 94 37 | +46 735 90 90 03

IFC: John Narayan Parajuli | nparajuli@ifc.org | +977 9851122684 | +977 14236000

About Dolma Fund Management:

Since 2014, Dolma Fund Management has built the largest private equity portfolio in Nepal and has set international standards for governance, investment management and reporting at fund manager and portfolio level. Dolma Impact Fund I was the first international private equity fund focussed on Nepal. Dolma Impact Fund II provides a clear pathway for making highly impactful investments in critical sectors in Nepal, framed by the Sustainable Development Goals.

About FMO:

FMO is the Dutch entrepreneurial development bank. As a leading impact investor, FMO supports sustainable private sector growth in developing countries and emerging markets by investing in ambitious projects and entrepreneurs. FMO believes that a strong private sector leads to economic and social development and has a close to 50-year proven track-record of empowering people to employ their skills and improve their quality of life. FMO focuses on three sectors that have high development impact: financial institutions, energy, and agribusiness, food & water. With a committed portfolio of EUR 9.7 billion spanning over 85 countries, FMO is one of the larger bilateral private sector developments banks globally. For more information: please visit www.fmo.nl

About CDC:

CDC Group is the UK’s impact investor with over 70 years of experience of successfully supporting the sustainable, long-term growth of businesses in South Asia and Africa. CDC is a leading player in the fight against climate change and a UK champion of the UN’s Sustainable Development Goals – the global blueprint to achieve a better and more sustainable future for us all.

The company has investments in over 1,200 businesses in emerging economies and a total portfolio value of $6.2bn. This year CDC aims invest $1.75bn in companies in Africa and Asia with a focus on fighting climate change, empowering women and creating new jobs and opportunities for millions of people. CDC is funded by the UK government and all proceeds from its investments are reinvested to improve the lives of millions of people in Africa and South Asia. CDC’s expertise makes it the perfect partner for private investors looking to devote capital to making a measurable environmental and social impact in countries most in need of investment.

In Nepal, CDC’s portfolio is over $23mn. It recently launched Nepal Invests, a market building platform. Last year, CDC invested in Nepal’s leading internet provider WorldLink, NMB Bank and the Upper Trishuli-1 Hydroelectric Project.

About Swedfund

Swedfund is Sweden's development finance institution for sustainable investments in developing countries. In order to achieve the goal - a world without poverty - more jobs are required in the private sector as well as increased access to renewable energy. Investments are therefore made within the energy & climate and healthcare sectors while also focussing on reaching small and medium-sized companies.

As a state-owned company, Swedfund is managed by the Ministry of Enterprise and Innovation. The operations are financed partly through capital injections for which the Ministry of Foreign Affairs is responsible and through reflows from our own portfolio.

For more information: please visit www.swedfund.se/en | www.edfi.eu

About IFC

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2020, we invested $22 billion in private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org.

Topics

Categories

About Swedfund

Swedfund is Sweden's development finance institution for sustainable investments in developing countries. In order to achieve the goal - a world without poverty - more jobs are required in the private sector as well as increased access to renewable energy. Investments are therefore made within the energy & climate and healthcare sectors while also focusing on reaching small and medium-sized companies.

As a state-owned company, Swedfund is managed by the Ministry of Enterprise and Innovation. The operations are financed partly through capital injections for which the Ministry of Foreign Affairs is responsible and through re-flows from our own portfolio.

For more information: please visit www.swedfund.se/en | www.edfi.eu