Press release -

Swedfund invests for climate resilient infrastructure and digital connectivity in Africa and emerging Asia

Swedfund, Sweden's development finance institution, is committing €40 million to the Emerging Africa & Asia Infrastructure Fund (EAAIF), a company of the Private Infrastructure Development Group (PIDG), managed by Ninety One. The investment will address infrastructure gaps in Africa, the Levant and South and Southeast Asia by supporting projects that elevate climate action and support inclusive and sustainable development.

Africa is the most energy-deficient continent, home to 75% of the global population lacking access to electricity. In Asia and the Pacific, over 350 million people have limited electricity access, while 150 million lack it entirely, according to the Asian Development Bank. This deficit extends beyond energy, hindering digital connectivity and limiting access to essential products and services in South Asia and sub-Saharan Africa, the least connected regions in the world.

— EAAIF plays a crucial role in financing impactful infrastructure projects in its markets, said Jérémie Hoffsaes from Swedfund’s Energy & Climate team. Through its contribution to EAAIF, Swedfund also aims to challenge risk perceptions around African infrastructure investments, build confidence and help mobilise private capital. This is essential to close the financing gap and build capital markets to achieve better environmental and social impact.

— EAAIF supports improving access to low-carbon infrastructure and taking action on both mitigation and adaptation to accelerate African and Asian industrialisation and close the energy access gap, whilst supporting the global transition to net zero. The impact from Swedfund’s commitment will be felt for decades, allowing us to deliver climate-resilient, inclusive infrastructure projects that transform economies and improve lives in Africa and Asia. Moreover, the affect is felt by people and businesses far beyond the original project location. Quality infrastructure enables people and businesses to plan for the future with confidence, says Martijn Proos Co-Head of Emerging Market Alternative Credit, Ninety One.

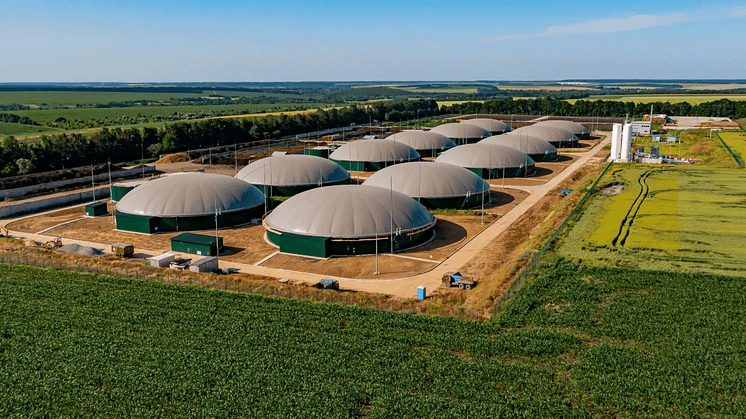

Since 2001, the EAAIF has provided patient debt capital for a geographically and sectorally diversified portfolio of high impact infrastructure projects in Africa and Asia worth more than US$2.5 billion. This includes US$42m of debt to support the construction and operation of the 46MW Biovea biomass plant in Côte d'Ivoire. This will improve income generation for 12,000 outgrowers, while increasing access to reliable electricity for 743,000 consumers and avoiding 120,000 tCO 2e per year.

Swedfund’s investment will focus on climate-resilient infrastructure projects that supports adaptation, facilitates net-zero transitions, and enhances digital connectivity. Where appropriate, these projects will receive PIDG’s technical assistance, which focuses on building resilience in underserved communities to enhance positive gender, inclusion, climate and nature outcomes.

Alongside private sector partners like Allianz and Standard Bank, Swedfund further strengthens EAAIF's capacity to deliver high-impact projects in complex markets.

***

About EAAIF

The Emerging Africa & Asia Infrastructure Fund (EAAIF) is a blended finance vehicle that raises and deploys public and private debt capital to transformative infrastructure projects across Africa, the Levant and South and Southeast Asia. EAAIF provides various debt products on commercial terms to infrastructure projects primarily owned, actively managed, and operated by the best in private sector expertise. The Fund helps create the infrastructure framework that is essential to stimulate economic stability, business confidence, job creation and poverty reduction. It has to date supported 96 closed infrastructure projects across 10 sectors in well over 20 African countries. EAAIF’s committed loan portfolio is US$1.35bn invested in 20 countries and across 10 sectors. EAAIF is part of the Private Infrastructure Development Group (PIDG). EAAIF was established and substantially funded by the governments of the United Kingdom, The Netherlands, Switzerland, and Sweden. In addition, it raises its debt capital from public and private financiers. EAAIF is managed by Ninety One. www.eaif.com

About PIDG

The Private Infrastructure Development Group (PIDG) is an innovative infrastructure project developer and investor which mobilises private investment in sustainable and inclusive infrastructure in sub-Saharan Africa and south and south-east Asia. PIDG investments promote socio-economic development within a just transition to net zero emissions, combat poverty and contribute to the Sustainable Development Goals (SDGs). PIDG delivers its ambition in line with its values of pioneering, partnership, safety, inclusivity, and urgency. PIDG offers Technical Assistance for upstream, early-stage activities and concessional capital; its project development arm – InfraCo – invests in early-stage project development and project and corporate equity. PIDG credit solutions include EAAIF (the Emerging Africa & Asia Infrastructure Fund), one of the first and more successful blended debt fund in low-income markets; GuarantCo, its guarantee arm that provides credit enhancement and local currency solutions to de-risk projects; and a growing portfolio of local credit enhancement facilities, which unlocks domestic institutional capital for infrastructure financing. Since 2002, PIDG has supported 233 infrastructure projects to financial close, which provided an estimated 230 million people with access to new or improved infrastructure. PIDG is funded by the governments of the United Kingdom, the Netherlands, Switzerland, Australia, Sweden, Global Affairs Canada, Germany, and the IFC. www.pidg.org

Topics

Categories

About Swedfund

Swedfund is Sweden’s development finance institution with the mission to reduce poverty through sustainable investments in developing countries. Swedfund plays an important role in the implementation of the 2030 Agenda and the Paris Agreement on climate. Swedfund shares the same goal as development cooperation in general, but the tools Swedfund uses are different. Swedfund has two instruments to fulfil its mission: sustainable investments in the private sector and technical feasibility studies through the Project Accelerator targeting the public sector.

Swedfund's investments contribute to the creation of decent jobs and increased access to essential products and services such as electricity and food. Swedfund is a long-term investor and is additional and catalytic through its investments and by mobilising private capital. Swedfund's feasibility studies support sustainable public infrastructure development, trade, and export opportunities for Swedish solutions.

We are part of Swedish development cooperation, and we measure and report all our results. As a state-owned company, Swedfund is managed by the Ministry of Finance and financed through portfolio reflows and annual capital injections for which the Swedish Ministry for Foreign Affairs is responsible.

For more information: please visit www.swedfund.se/en